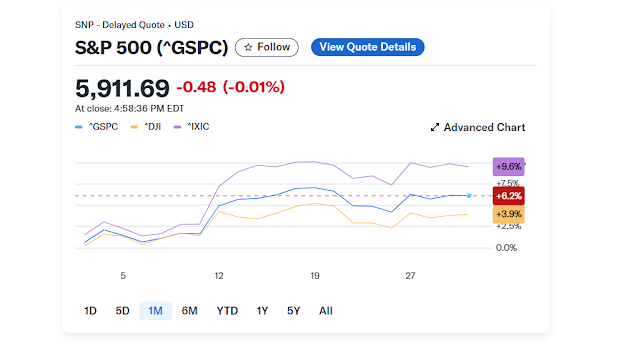

NEW YORK, NY | May 31, 2025 — U.S. stock markets wrapped up May on a bullish note, defying early-session volatility to post impressive monthly gains. The S&P 500 closed out its strongest May since 1990, jumping more than 6%, driven by investor optimism surrounding potential tariff relief and positive economic indicators.

|

| Image Source: Yahoo.com |

The Dow Jones Industrial Average added 4% during the month, while the Nasdaq Composite soared nearly 10%, fueled by strong momentum in the technology sector. These gains mark the S&P 500's most significant monthly rally since November 2023.

Market Overview: May 31, 2025

On Friday, the Nasdaq dipped slightly by 0.3%, recovering from a steeper early-session loss of over 1.6%. The S&P 500 remained near break-even, while the Dow posted a modest 0.1% gain. Despite daily fluctuations, all three indexes ended the week and the month in positive territory.

Geopolitical Tensions and Trade Policy in Focus

Investor sentiment was tested throughout the month by renewed U.S.-China trade tensions. According to Bloomberg, the Trump administration is drafting new measures to tighten restrictions on Chinese technology firms, specifically targeting subsidiaries of companies already on the Entity List. The proposed rule would require U.S. licenses for transactions involving such firms, potentially intensifying the ongoing trade conflict.

President Trump also made waves on Truth Social, accusing China of breaching its trade commitments, just weeks after both nations appeared to be reaching a tariff truce. The escalating rhetoric has raised concerns about a prolonged standoff between the world’s two largest economies.

Trade Talks and Legal Developments Add to Market Uncertainty

Trade negotiations appear to have hit a standstill, with Treasury Secretary Scott Bessent noting that progress has stalled. Speaking on Fox News, Bessent suggested that a direct conversation between President Trump and Chinese President Xi Jinping might be the only way to move forward.

At the same time, a U.S. appeals court temporarily reinstated Trump-era global tariffs, pausing a lower court's decision that had blocked them. The administration has until Monday to formally appeal, while also exploring alternative methods to reintroduce tariffs without legal setbacks.

Cooling Inflation Boosts Investor Confidence

Adding to the optimism was the latest inflation data, which showed continued moderation. The Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge, showed that core inflation—which excludes volatile food and energy prices—rose in line with market expectations on both a monthly and yearly basis in April.

This cooling inflation trend supports investor hopes that the Federal Reserve may hold off on additional interest rate hikes, providing a more stable environment for equities to thrive.

📌 Key Highlights:

-

S&P 500 posts best May performance in 34 years, up over 6%.

-

Tech sector drives nearly 10% monthly gain in the Nasdaq Composite.

-

Trump administration eyes tighter export controls on Chinese tech firms.

-

Tariff negotiations with China stall, adding to geopolitical uncertainty.

-

Inflation shows signs of easing, aligning with Fed forecasts.